Why the Global Plant Extracts Market Matters to B2B Buyers

The global plant extracts market is no longer just “growing” — it is reshaping how ingredients are sourced, evaluated, and commercialized.

For B2B buyers in:

- dietary supplements

- functional foods

- cosmetics & personal care

- OEM/ODM manufacturing

plant extracts have become core value ingredients, directly affecting:

- product efficacy

- regulatory approval

- brand positioning

- long-term cost control

This article focuses on what actually matters to buyers, not just headline market numbers.

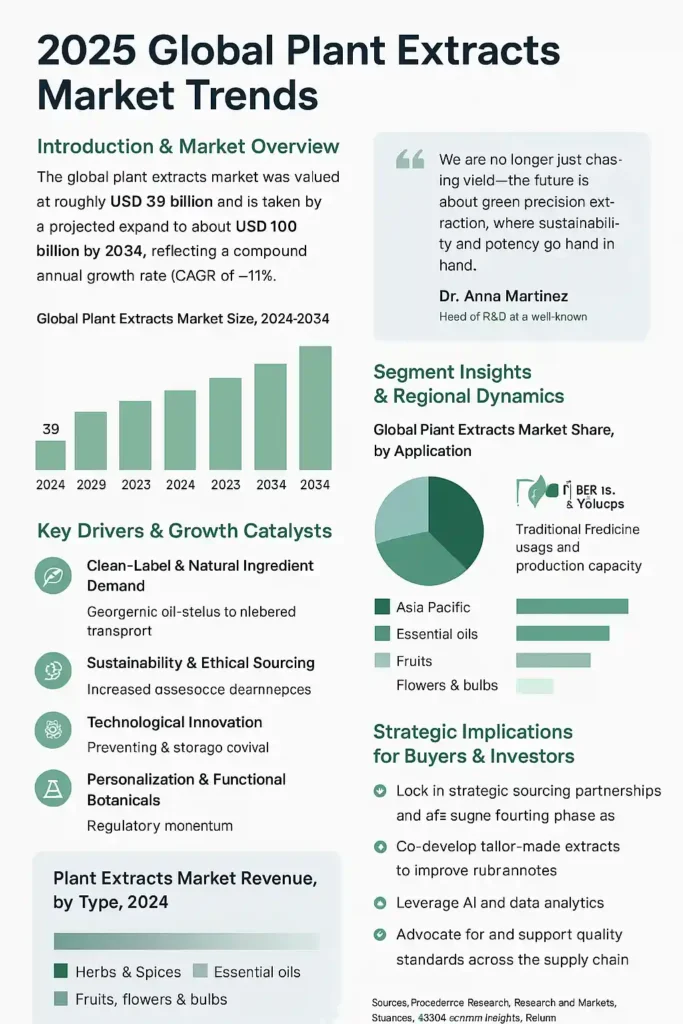

Global Plant Extracts Market Size & Growth Outlook (Authoritative Data)

According to multiple international market research institutions:

- MarketsandMarkets estimates the global plant extracts market will grow from approximately USD 47–48 billion in 2025 to over USD 85 billion by 2030, with a CAGR above 12%.

- Mordor Intelligence reports a more conservative but still robust growth trajectory, projecting a CAGR of ~8–9% between 2025 and 2030.

- Business Research Insights confirms sustained demand growth across supplements, cosmetics, and food applications, particularly in North America, Europe, and Asia-Pacific.

What Is Actually Driving Demand for Plant Extracts?

1. Clean Label Is Now a Procurement Requirement

“Natural” and “plant-based” claims are no longer marketing add-ons — they are minimum entry requirements in many markets.

For B2B buyers, this translates into:

- replacing synthetic actives with botanical extracts

- demanding traceability and ingredient transparency

- prioritizing standardized plant extracts over raw powders

2. Functional Performance Over Ingredient Names

Buyers are shifting from:

“Which plant extract is popular?”

to:

“Which extract delivers measurable functionality in my formulation?”

This trend favors:

- standardized active content

- application-specific extracts

- suppliers who understand formulation, not just raw materials

3. Regulatory Pressure Is Reshaping Supplier Selection

Regulatory frameworks in the EU, US, Japan, and Southeast Asia increasingly require:

- heavy metal and pesticide control

- solvent residue limits

- batch-to-batch consistency

As a result, supplier qualification has become a strategic decision, not a purchasing task.

Market Segmentation That Matters for B2B Procurement

By Application (Buyer-Oriented View)

| Application | What Buyers Care About Most |

|---|---|

| Dietary Supplements | Active markers, stability, bioavailability |

| Functional Foods & Beverages | Taste, solubility, heat stability |

| Cosmetics & Personal Care | Safety data, skin compatibility, compliance |

| Pharmaceutical & Herbal | GMP level, validation, pharmacopoeia standards |

By Extract Type

- Standardized plant extracts → fastest-growing B2B segment

- Organic & clean-label extracts → premium but regulation-sensitive

- Customized botanical blends → driven by OEM and private-label demand

Regional Market Trends Buyers Should Understand

Asia-Pacific

- Major global source of botanical raw materials

- Cost advantages, but quality variability remains a risk

- Buyers must focus on auditability and documentation

Europe

- Strong regulatory framework

- High demand for compliant, standardized extracts

- Lower tolerance for inconsistent suppliers

North America

- Innovation-driven demand

- Strong focus on efficacy, traceability, and scalability

Key Challenges B2B Buyers Face (and Google Actually Ranks These)

1. Raw Material Price Volatility

Climate change, harvest cycles, and geopolitical disruptions increasingly affect botanical availability.

Buyer strategy:

Long-term sourcing contracts + multi-origin planning.

2. Quality Inconsistency Between Batches

One of the most common buyer complaints:

“The first batch was fine, the second was not.”

This issue is strongly correlated with:

- non-standardized extraction processes

- weak in-house QC systems

3. Hidden Compliance Risks

Many extracts appear “natural” but fail:

- solvent residue tests

- heavy metal thresholds

- labeling requirements

These failures often surface late in product development, increasing cost and time to market.

How Smart B2B Buyers Are Responding (2025–2030 Strategy)

1. Buying Specifications, Not Just Products

Leading buyers define:

- active content ranges

- extraction solvents

- application compatibility

before requesting quotations.

2. Evaluating Suppliers as Long-Term Partners

Key evaluation criteria now include:

- manufacturing standards (GMP, ISO)

- documentation readiness (COA, MSDS, traceability)

- ability to support regulatory filings

3. Aligning Ingredient Strategy With Brand Strategy

Plant extracts are increasingly used to:

- support clinical positioning

- justify premium pricing

- differentiate products in saturated markets

What This Means for OEMs & Brand Owners

Between 2025 and 2030, competitive advantage will shift toward companies that:

- control ingredient quality at the source

- work with technically capable extract manufacturers

- integrate sourcing decisions early in product development

Plant extracts are no longer “interchangeable ingredients” — they are strategic assets.

Conclusion: A Growing Market, But a Smarter Buyer Wins

The global plant extracts market offers strong growth opportunities, but only informed buyers capture the real value.

Success in this market depends on:

- understanding functional requirements

- managing regulatory risk

- building reliable supplier relationships

Those who invest in smarter sourcing strategies today will lead tomorrow’s market.

Authoritative References & Data Sources

- MarketsandMarkets – Plant Extracts Market Size & Forecast (2025–2030)

- Mordor Intelligence – Global Plant Extracts Market Analysis

- Business Research Insights – Plant Extracts Market Trends & Regional Outlook

- FAO (Food and Agriculture Organization of the United Nations) – Botanical raw material supply & agricultural trends

- EFSA / FDA public guidance documents – Botanical ingredient regulatory frameworks

Bulk Supply & Technical Support

Get direct factory quotes, COA, and MSDS within 12 hours. We support bulk supply and custom specifications.